[ad_1]

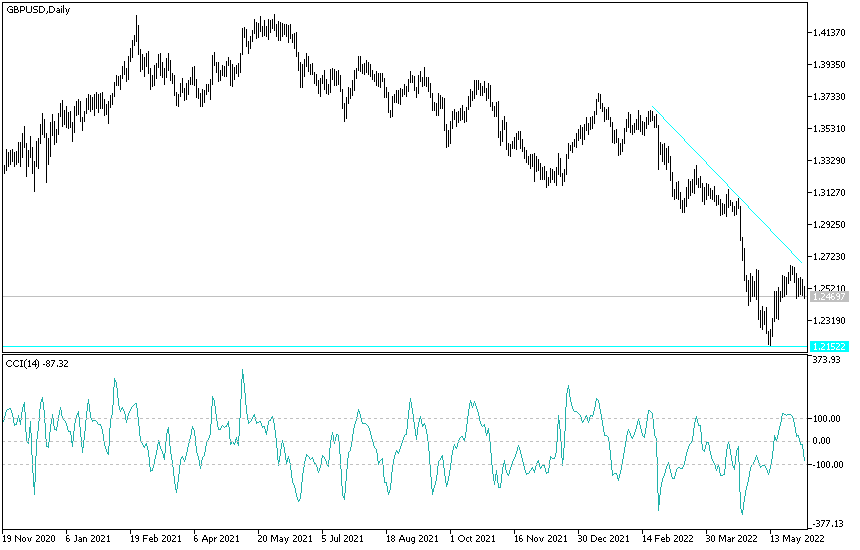

The gains of the GBP/USD currency pair may be subject to a rapid collapse, as political anxiety remains in Britain. Renewed concern about the Brexit agreement, along with the pessimism of the Bank of England, is offset by the intention of the US Federal Reserve to raise the interest rates in America strongly during the year 2022. Yesterday, the price of the GBP/USD currency pair has been subjected to selling operations that settled in its impact towards the support level 1.2430 at the time of writing the analysis.

The pound against the dollar has entered the new week’s trading and may struggle to fend off the dollar’s rally ahead of the important US inflation numbers on Friday for the month of May, which may be key to see if the British pound is able to do so. Avoid retesting last month’s lows. The British pound attempted to recover from an earlier drop below the 1.25 level during the weak holiday period late last week but was held back by the dollar’s rebound after US payroll and PMI numbers confirmed continued upside risks to the Fed’s policy outlook.

While jobs data and industrial surveys clearly indicated that momentum in the labor market and other key economic sectors in the US is slowing, they also made it clear that risks to the US inflation outlook remain to the upside. This, in turn, suggests that the Fed will continue to have room to push higher expectations on US interest rates in the coming months, which could represent additional headwinds for the pound against the dollar, if not a direct burden on the pound.

Wage growth detailed in Friday’s US payroll report eased slightly, but both PMI surveys indicated that demand for workers was still rising along with their demands for wages and some other prices, which came as headwinds for the pound against the dollar. This may be because these are all things that could drive inflation along the line and therefore likely cause the Fed to be more interested in continuing to raise rates in larger than usual increases for the rest of the year.

According to the technical analysis of the pair: On the daily chart, if the GBP/USD price returns below the 1.2385 support, the bears will return to control the trend and the recent bullish expectations will end. Breaking this support will return the expectations of the collapse to the psychological support 1.2000 again. On the other hand, the bulls must break through the resistance levels 1.2675 and 1.2800 to give the bullish expectations a boost, and I still prefer to sell the GBP/USD from each ascending level.

[ad_2]