[ad_1]

Shorting is not a possibility at this point.

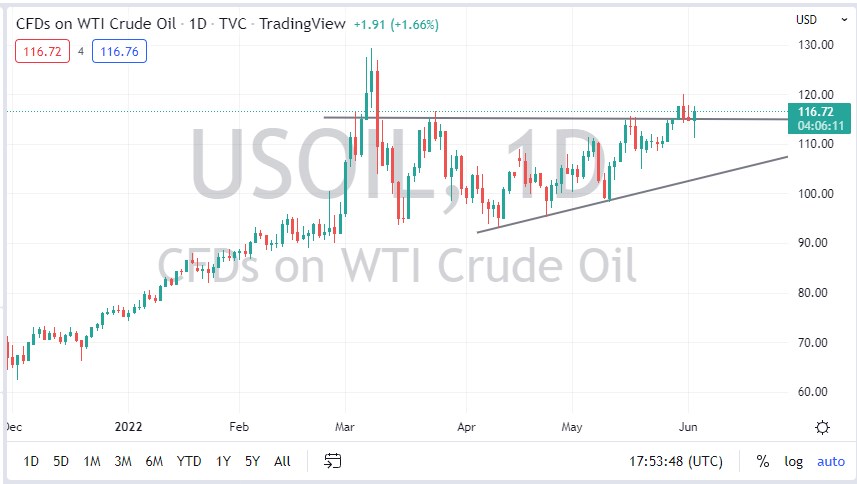

The West Texas Intermediate Crude Oil market has fallen rather hard, to begin with on Thursday but turned around to show signs of life just above the $110 level. By doing so, the market looks as if it is trying to break out and reach above the $120 level eventually. That being said, what’s worth noting is that we had seen the ascending triangle for the market hold as support during the session on Thursday, so it looks like we are going to continue to see buyers on dips. Ultimately, I think this market will go looking to the $120 level as a potential target.

Oil prices are making great trade opportunities

If we turn around and break down below the $110 level, that would obviously be a very negative turn of events but I think at this point we probably have quite a bit of volatility to chew through, especially as the jobs number comes out on Friday. Because of this, I think that any debt will have to be looked at as potential buying opportunities, just as we have seen over the last couple of weeks. If we can break above the $120 level, then the market is free to go back to the highs again.

Crude oil will continue to get a bit of a bid as the Chinese are reopening their economy, thereby driving up demand. The market has shown itself to be very noisy, but it is resilient. I think that continues to be the case as there are so many moving pieces right now that it’s almost impossible to get a grip on everything that moves. After all, the concern about global growth slowing down and then the concern about inflation at the same time has made the market messy to say the least. At this point, it’s difficult to imagine a scenario in which things are going to be easy, so please keep that in mind. Ultimately, this is a market that I think will have to figure out its next move through a “wall of worry”, but it certainly looks as if we are focusing on the upside instead of the down. With this being the case, I would anticipate that the market will eventually hit $130, but it may be quite an adventure getting there. Shorting is not a possibility at this point.

[ad_2]