[ad_1]

The crude oil markets have been bullish for quite some time, and now that we have worked out a lot of volatility, it’s likely that we will be able to stabilize and grind higher.

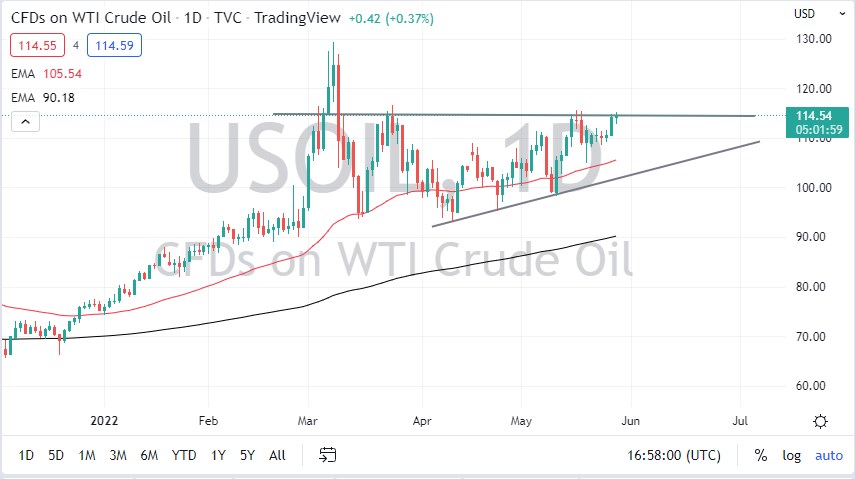

The West Texas Intermediate Crude Oil market initially pulled back just a bit on Friday but turned around to show signs of life again. By doing so, the market will have traders thinking that a breakout is imminent. I recognize that there is an area between the $115 and the $116 levels that is a bit difficult. Breaking above there is the next challenge but based on the candlestick that we have formed for the Friday session, that’s likely to happen rather soon.

Keep in mind that there are a lot of concerns about supply to begin with, but now that China seems to be ready to reopen, that should drive more demand going forward. That is the biggest story right now, perhaps right along with the Russian invasion of Ukraine. Nonetheless, we are entering a traditionally bullish time of year anyway, as the summer driving season begins. Now that the market is pricing in a reopening trade and of course China will only exacerbate that, there are plenty of reasons to think that this market is going to go higher.

It’s also worth noting that the most recent pullback stopped just above the 50-day EMA, so in that scenario, it has performed much better than it had in the three previous breaks, which tested the uptrend line. Ultimately, this is a market that is more likely than not going to continue to attract a lot of value hunting, and it’s very difficult to imagine a scenario where you could be a seller. In fact, it’s not until we break down below the uptrend line that there is a potentially negative setup. Anything between now and then that is a pullback will more likely than not will be thought of as a value proposition.

As far as a target is concerned, the recent highs at the $128 level could be a potential target. The crude oil markets have been bullish for quite some time, and now that we have worked out a lot of volatility, it’s likely that we will be able to stabilize and grind higher. That does not necessarily mean that it will be an easy trade, but it certainly looks as if it is the most likely of direction going forward.

[ad_2]