[ad_1]

We are trying to form a short-term double bottom, so that might offer the possibility of a bounce.

Solana markets have fallen a bit during the trading session on Thursday to reach as low as $42. However, we have bounced ever so slightly since then, suggesting that we are trying to do whatever we can to find buyers. The $40 level is an area where we have seen a little bit of interest as of late, so you could make an argument for a small “double bottom” trying to be formed. That being said, there’s no reason to think that Solana is suddenly going to take off to the upside because quite frankly most of the crypto market is a complete disaster at this point.

If we were to break down below the $40 level, Solana will drop another $10 rather quickly, perhaps even fall all the way back down to the $20 level. Solana is going to continue to be eviscerated as long as crypto markets are struggling. After all, Solana is rather far out on the risk appetite spectrum, so you need to be very cautious about the market as there are a lot of concerns out there. There’s no reason to think that people are suddenly going to jump into Solana when they cannot trust most other markets.

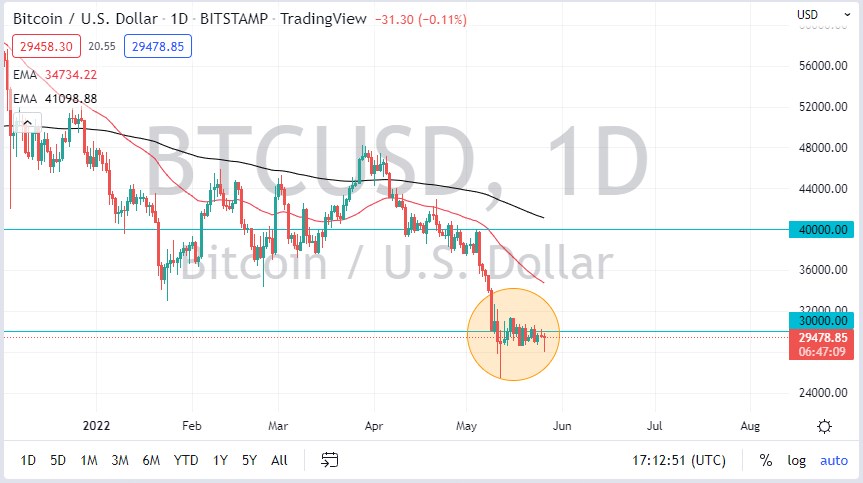

You also cannot ignore the “knock-on effect” of other crypto markets, as the bigger markets have struggled. Ethereum and Bitcoin both looked rather limp, so that will continue to drive money away from Solana. There is no way that people are going to feel comfortable buying this market if they are not comfortable buying Bitcoin. That being said, you can use the Bitcoin and the Ethereum charts as secondary indicators, as a strong move to the upside could have people looking for bigger gains in markets like this. The market will look at the $60 level in the Solana market as a potential resistance barrier. If we can break above there, then the next barrier will be the 50 Day EMA.

Regardless, this is a market that is in a major downtrend, and I just don’t see how it changes anytime soon. Adding more fuel to the fire is that the US dollar is strengthening overall, showing that there is a general run towards quality, and away from risk. That being said, we are trying to form a short-term double bottom, so that might offer the possibility of a bounce.

[ad_2]