[ad_1]

This is yet another time that crypto has gotten hammered as we try to figure out exactly what function it will serve.

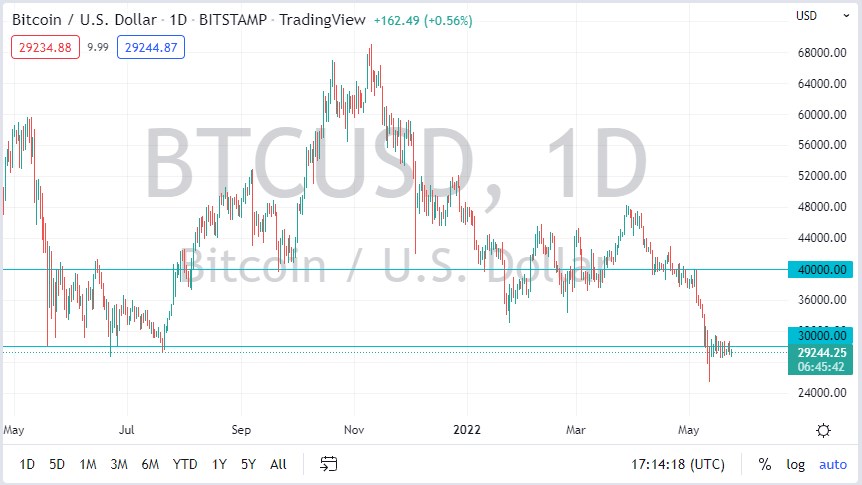

The Bitcoin market did almost nothing on Tuesday as we continue to look at the $30,000 level as difficult to overcome with any type of confidence. Bitcoin and the rest of the crypto market continue to struggle at the hands of risk appetite. You could also make a bit of an argument that we are forming a descending triangle, which is also a very bearish sign.

It’s worth noting that the hammer from last week suggests that there is a certain amount of support underneath, and a lot of interest will be had near the $25,000 level. That being said, the $25,000 level will more than likely get broken through, due to the fact that it was a minor area of interest in the past. Breaking through there allows Bitcoin to go looking toward the $20,000 level underneath, which had previously been both support and resistance. The $20,000 level could be an area where you would see value hunters coming back, but at this point anything is possible.

When you look at the chart, rallies could happen, but there are plenty of areas above that could cause problems. The 50-day EMA sits near the $35,000 level, and I believe that it is only a matter of time before sellers will jump in. In fact, the market will more likely than not continue to see resistance above there all the way to the $40,000 level. Either way, I have no interest in buying Bitcoin anytime soon, because the risk appetite simply does not allow it.

The downward trajectory has been brutal, but at this point, I think it is only a matter of time before it continues. The action over the last couple of weeks has simply been the market trying to work off some of the fraud from the downward momentum, but as the US dollar continues to strengthen and central banks around the world continue to look at tightening monetary policy, it is obvious that Bitcoin is not an inflationary hedge. In fact, it seems to be very highly correlated with the NASDAQ. In other words, it needs more of a “risk-on environment” to pick up a bit of a bid. This is yet another time that crypto has gotten hammered as we try to figure out exactly what function it will serve.

[ad_2]