[ad_1]

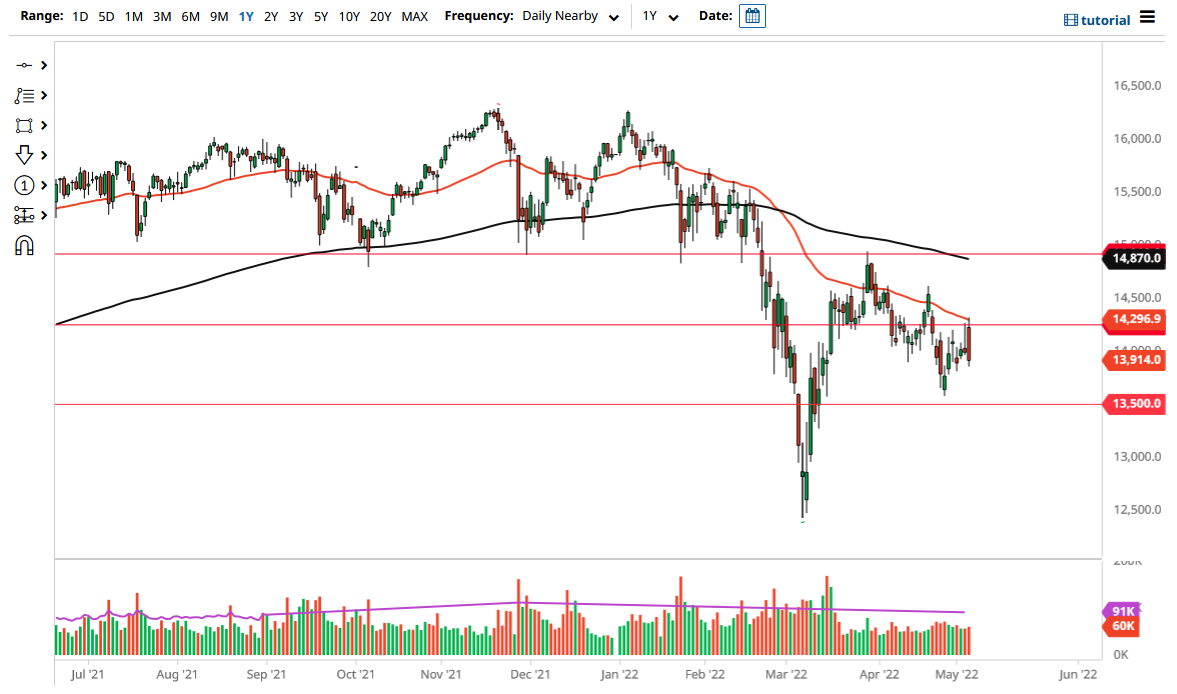

We are still in a very significant down-trending channel, and I think that will continue to be the way going forward.

The German index gapped higher to kick-off to the upside at the open on Thursday but has rolled over significantly to show weakness. Quite frankly, a lot of the world lost its mind after Jerome Powell suggested that a 75 basis points rate hike was off the table. There was a significant “relief rally” that all markets across the world experienced initially, but the German index was no different than the other ones, where we had broken down once people thought about it.

The 50 Day EMA is of course a significant indicator that a lot of people are paying close attention to and the fact that it is hanging around the €14,250 level, an area that has been resistant a few times. We are still in a very significant down-trending channel, and I think that will continue to be the way going forward. That is a situation where the market has continued to see sellers coming back in and punishing this market every time it tries to get a little bit bullish.

The size of the candlestick is of course something worth paying attention to because we just had a major reversal. In fact, it has ended up being somewhat of a “bearish and coughing candle”, so a lot of technical traders will be paying close attention to it as well. If we break down below the bottom of the candlestick, then I think the €13,500 level will be targeted next. That is an area that has been supportive in the past, so it does make a certain amount of sense that we would try to get there. If we break down below that level, we go much lower, perhaps unwinding the market down to the €12,500 level.

If we turn around and break above the €14,500 level, then it is possible that we could have a bigger move, opening up the possibility of a move to the 200 Day EMA. The 200 Day EMA is currently sitting at the €15,000 area, so it would make a certain amount of sense that it would be a target and a potential barrier that will be difficult to overcome. Quite frankly, this is a market that is going to suffer right along with the rest of the world, as there has been a significant shift in expectations as far as growth is concerned.

[ad_2]