[ad_1]

Ultimately, volatility is the only thing that I see over the next couple of days.

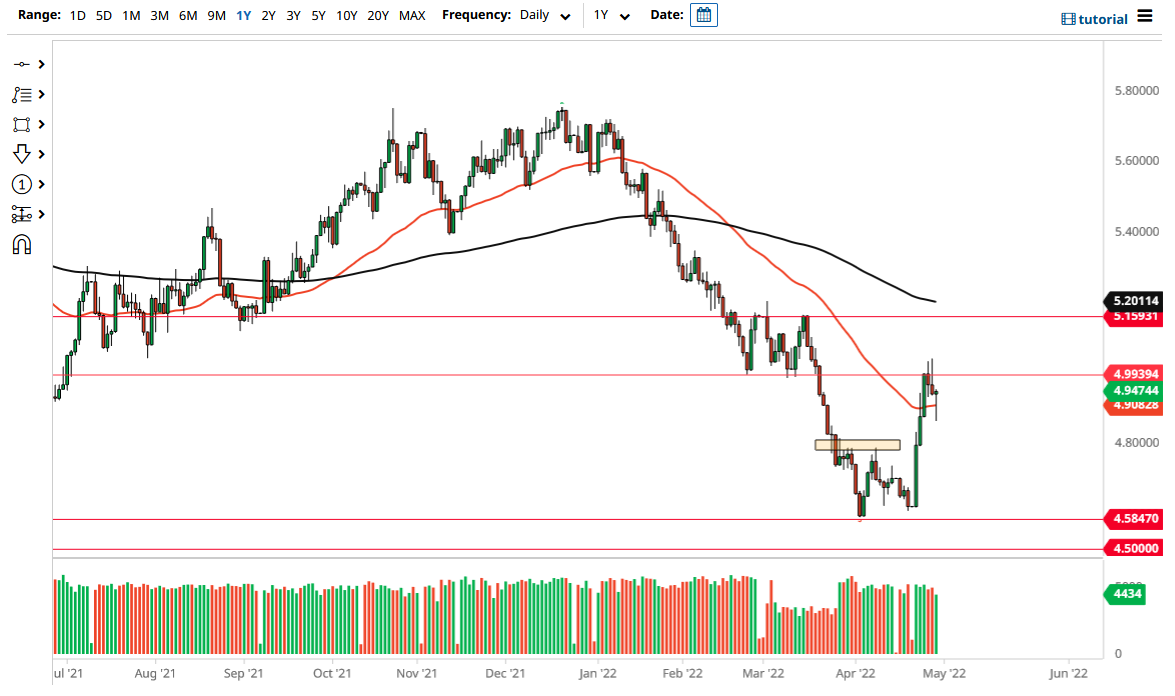

The US dollar initially fell on Friday but turned around to show signs of life as it formed a hammer. The hammer sits at the 50-day EMA, and it looks as if we are going to try to break higher at this point to go looking to the 5.00 BRL level. The fact that we have formed a hammer and a shooting star back to back suggests that we are going to try to keep it in a tight consolidation area. Furthermore, we will more likely than not get some type of breakout that we can take advantage of.

Latin American currencies can give great price movements.

Trade them with our featured broker.

Trade Now !

Once we break out of this range, it is likely that we could go much higher, or perhaps much lower. If we do break out to the upside, the 5.15 level could be a target. On the other hand, if we were to turn around a breakdown below the hammer from the session on Friday, as likely that we go looking to the 4.80 level after that.

Keep in mind that the US dollar is sensitive to risk appetite, and as a result, you need to pay close attention to whether or not the US dollar is rising against everything or not. After all, the US dollar does tend to move in the same direction in multiple markets, so I don’t think that the Brazilian real is going to be any different. This is a market that is building up inertia in order to make the next bigger move. Keep in mind that risk appetite is highly influential when it comes to emerging market currencies such as the Brazilian real.

The Brazilian real also is highly sensitive to commodities, and we have seen a lot of noise as of late when it comes to the soft. As long as that is going to be the case, we will be all over the place. Furthermore, the Federal Reserve looks as if it is going to continue to be very hawkish, and that suggests that we could continue to see the US dollar recover some of its losses from the higher-yielding Brazilian currency. If we can break above the 5.15 level, we could really start to take off to the upside. Ultimately, volatility is the only thing that I see over the next couple of days.

[ad_2]