[ad_1]

The British pound is on track to record a third consecutive monthly decline against the euro and the fourth consecutive monthly decline against the US dollar as investors continue to abandon the British currency.

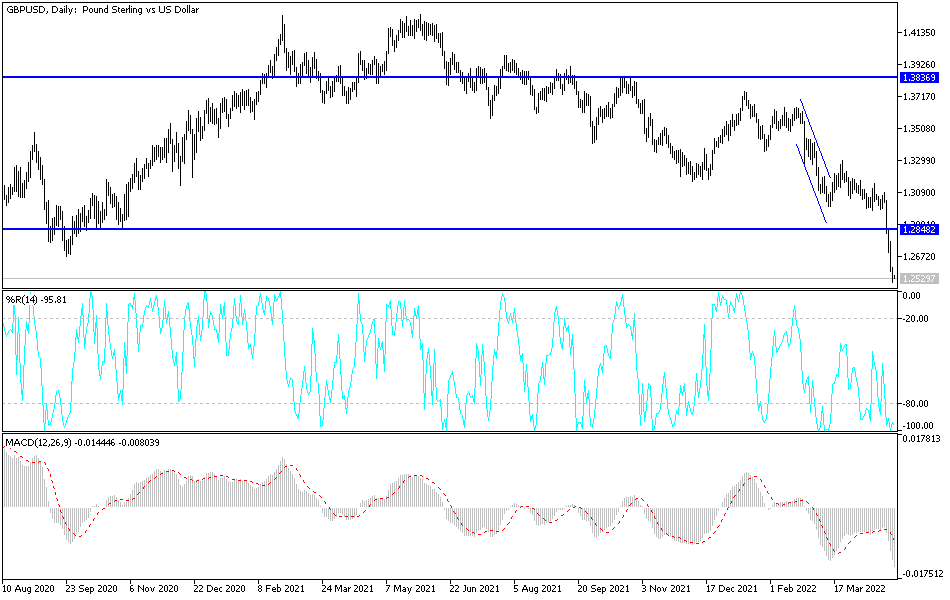

In the case of the GBP/USD currency pair, it has fallen to the 1.2500 psychological support level, the lowest for the currency pair since July 2020, and is settling around the 1.2540 level at the time of writing the analysis. This is amid the continued strength of the US dollar with expectations of raising US interest rates.

The latest move in the British pound comes amid a significant drop in global stock markets, indicating that investors are increasingly pessimistic about the implications for the forex foreign exchange markets. “Currency traders are running for the hills,” says Jeremy Bolton, Reuters market analyst. “The dollar is rising as liquidity is heading towards safe assets… Previously, demand currencies weakened significantly.”

The British pound is one of these “previously in demand currencies”.

The British currency is under severe pressure and not only depreciates against the euro, dollar and other traditional “safe haven” currencies such as the franc and the yen; Worryingly, it is declining against most major currencies.

The question now is: Why is the price of the pound declining?

There are two prominent reasons:

1) Sterling tends to struggle when markets are down, and sentiment is as it is now. This dynamic was clearly demonstrated during the Great Financial Crisis when the exchange rate of the pound to the euro fell to an all-time low, and it was highlighted again during the Covid crisis:

With Britain running a large current account deficit, the value of sterling depends heavily on global investor inflows: when times are good, and investors take advantage of sterling as capital flows into the UK.

When investors liquidate their positions, money flows in again, weighing on the pound. This dynamic is certainly true in 2022 when the country’s current account deficit remains as wide as ever.

If global markets and investor sentiment remain under pressure, so will sterling. Currently, investors are concerned that the Chinese economy is about to come to a halt which will negatively impact global growth rates and thus hurt investor sentiment

Beijing could be the next mega-city to go into lockdown, which isn’t good for global investor sentiment. Meanwhile, the war continues in Ukraine, where the news that Russia has cut off gas supplies to Poland has not been well received by the markets.

Currently, concerns are growing about the future of the British economy and this may explain why the British Pound is currently one of the worst performing currencies in the world. Accordingly, analysts comment, “The pound has been hovering around its lowest level in more than a year and a half against the US currency, as consistent evidence of a slowing UK economy suggests that the Bank of England is raising interest rates to fight the highest rate of inflation in decades.”

Economists at Deutsche Bank warned yesterday that recession risks in the UK are rising as the cost of living rises and households shrink. “Recession warnings are flaring up further,” says Sanjay Raja, chief economist at Deutsche Bank, in a new research note released on April 26. Deutsche Bank now expects inflation (CPI) to reach the highest 9% year-on-year in April and October this year, “significantly hitting purchasing power”.

Moreover, tax increases from April will affect household budgets and consumer confidence has already fallen to stagnation levels according to Raja. Meanwhile, real wages are expected to shrink 4% in 2022 in what amounts to one of the worst real-term cuts to packet pay since World War II.

Business confidence is waning amid rising cost pressures and lower operating margins. The set of “recession models” used by Deutsche Bank all point to one thing Raja says: “The probability of a recession is increasing.” In contrast. There is still demand for the dollar, and its rise accelerated amid a broad deterioration in global investor sentiment, which sent the pound exchange rate against the dollar to its lowest level in 21 months.

According to the technical analysis of the pair: On the daily chart, the price of the GBP/USD currency pair moved towards the 1.2500 psychological support level, confirming the bears’ strong and continuous control over the trend for a while. The sterling is looking for factors to stop its losses, and we see that any indications from the Bank of England of the future of a strong tightening of its monetary policy, coinciding with the direction of the Federal Reserve, may provide support for the pair in rebounding higher.

The GBP/USD is testing stronger support levels and the closest ones are currently 1.2475 and 1.2300, respectively. On the other hand, the currency pair may need to break the psychological resistance 1.3000 to have an opportunity to break the current bearish outlook.

[ad_2]