[ad_1]

Amid continuing weakness factors (a strong future for raising US interest rates – the Russian / Ukrainian war – an uncertain future for raising interest rates from the European Central Bank – the strong performance of the US economy compared to the Eurozone economy) the downward trend of the EUR/USD currency pair continues. We said before that the euro might be exposed to more selling once it crossed the 1.0800 psychological support, and it has already happened, as the losses of the most popular currency pair in the Forex market reached the 1.0635 support level, the lowest in two years. It stabilized around it at the beginning of trading Wednesday.

FX analysts at DNB Markets say the euro breakout below $1.08 won’t last long and they expect a steady recovery through the end of the year. So the Scandinavian lender and investment bank says that the EUR is traditionally and structurally not susceptible to the current lows we are currently seeing and that the ECB could soon provide some support via the yield channel.

There is no doubt that DNB Markets is acknowledging the pressures in the near term and is not yet inclined to call for an imminent recovery. In this regard, analyst at DNB Engfield Burgen says that the expected higher interest rates in the United States compared to other major economies, along with its status as a safe haven in times of market turmoil, is the reason behind the strength of the US dollar against other G10 currencies recently.

“This is also evident in the euro against the US dollar, which fell back below 1.08, despite the relief of Emmanuel Macron’s strong victory in the French presidential election on Sunday,” Borgen adds.

To be sure, DNB Markets has identified some investor nervousness embedded in the Eurodollar: they believe that some of the drop in the EUR/USD pair, from 1.11 in mid-March to 1.08 in mid-April, was due to a small “Le”. The pen risk premium is priced in the euro, as Macron’s lead over Le Pen in the polls has narrowed somewhat in this time period. But “the fact that EUR/USD did not recover any of this but fell further after Macron’s victory is in our view emblematic of how sensitive the EUR/USD is currently to the volatility of risk appetite.”

The drop in global stock markets linked to China’s growth concerns with the introduction of Covid lockdowns appears to be a major concern for investors at the moment. These concerns came along with the dollar’s rise to a two-year high.

But DNB Markets maintains the view that EUR/USD will be trading well below 1.08 for an extended period. Accordingly, the analyst adds, “The main reason for this is that the euro against the dollar EUR/USD has never traded, since 2002, at such low levels except for short periods in which monetary policy in the United States and the eurozone moved in two completely opposite directions.”

Moreover, “while the Fed is preparing to tighten policy faster than the ECB, we believe the ECB is ready to start raising interest rates and end quantitative easing later this year, and that this will change investor sentiment toward the euro.” She says that this will further strengthen the euro against the US dollar in the long run. In a 12-month period, DNB Markets has forecast EUR/USD to trade at 1.10.

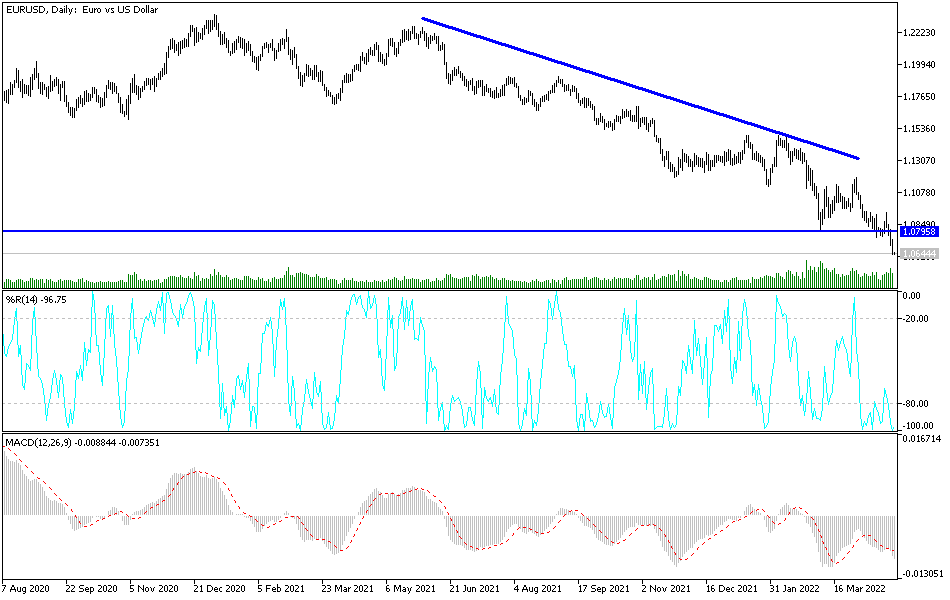

The general trend of the EUR/USD is still bearish, taking into account that the recent losses were enough to push the technical indicators towards oversold levels, as is evident on the daily chart. The current path, therefore, may be subject to further testing of stronger support levels, the closest of which are currently 1.0580 and 1.0400.

On the other hand, and as I mentioned before, the EUR/USD has to break through the psychological resistance 1.1000 to have an opportunity to break the current descending channel.

[ad_2]