[ad_1]

Demand is going to be a big deal, as we are starting to slow down globally, meaning that we might have a lot of demand destruction.

The US dollar went back and forth against the Brazilian real during the Wednesday session. By doing so, it looks like we are going to continue trying to stabilize the overall market. After all, we had formed a hammer during the Tuesday session as well, so this is the beginning of that attempt. The market had been falling for quite some time, so it certainly makes a significant amount of sense that we would see a lot of noise in this area.

Latin American currencies can give great price movements.

Trade them with our featured broker.

Trade Now !

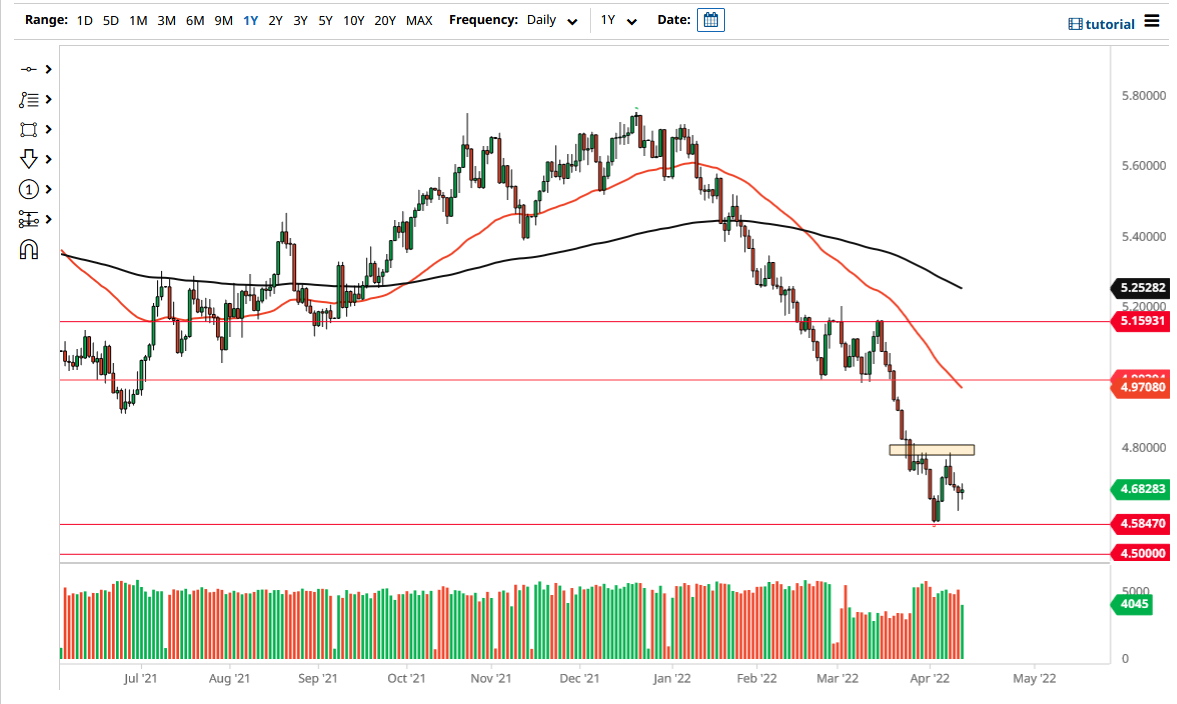

If we do continue to fall, the 4.58 level has been significant support previously, so I do think that it is probably only a matter of time before we see that area offer enough interest for buyers to get involved. If we break it down below there, then we will almost certainly see this market dump rather quickly to the 4.50 level. That has a lot of psychology attached to it, so people will be paying close attention to it, and I think it would be difficult to break through. Having said that, we are clearly in a downtrend, so it does make sense that we could reach there.

As you can see on the chart, I have a box at the 4.80 level, and I think that is a significant amount of resistance, and a break above there would be a very good sign. At that point, I think we would challenge the 50-day EMA, and perhaps even try to bounce to the 5.00 level. It would obviously be a “risk-off” type of move, or perhaps everybody is running to the US dollar. Having said that, the US dollar has been strengthening for quite some time, even as it has been falling against the real. This is because Brazil has been benefiting from the commodities boom, as it is a major exporter of a lot of soft commodities. If the commodity markets start to unravel, that could put pressure on the Brazilian real, turning this market around.

Demand is going to be a big deal, as we are starting to slow down globally, meaning that we might have a lot of demand destruction. If that is the case, we may be getting close to the end of the Brazilian real rally.

[ad_2]