[ad_1]

The markets will continue to be paying close attention to a lot of moving pieces, and at this point you cannot count on too much more than volatility.

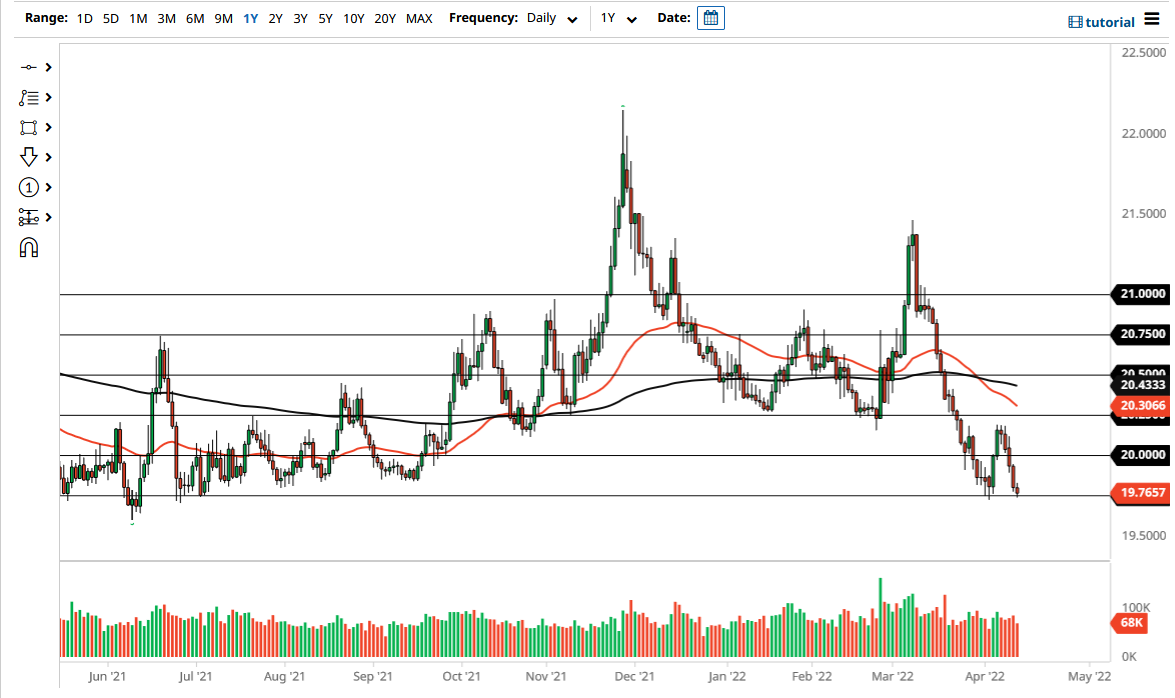

The US dollar is currently sitting just above the 19.75 pesos level, an area that had recently caused a bit of a bounce. The Mexican peso is highly correlated to oil, which had a very strong move during the trading session, but it is also a situation where the interest rate differential between Mexico and the United States continues to favor the peso as well.

Latin American currencies can give great price movements.

Trade them with our featured broker.

Trade Now !

The 19.75 level has been important more than once, and you can see on the chart that I have every 0.25 pesos marked. That is the increment that this market does tend to move in, so I think that if we break down below the 19.75 pesos level, is very likely that we could go looking to reach the 19.50 pesos level. Ultimately, if we were to turn around, I think that we will probably have a bit of a barrier in the form of 20 pesos, and although we have sliced through it a couple of times, there is a certain amount of psychology attached to it.

Looking at this chart, we have recently had the “death cross” form which is when the 50-day EMA crosses below the 200-day EMA, and it is worth noting that this market does tend to trend for long periods of time. With that in mind, we may see a continued strengthening of the peso, especially if interest rates continue to rise the way they have in Mexico. Furthermore, oil adds a bit of a punch to the peso as well, as so many of those rigs in the Gulf of Mexico are Mexican.

If we were to turn around and rally, I think we would have to clear the 20.25 pesos level to have any credible rally that needs to be taken with anything more than a grain of salt. In that scenario, we could go looking towards the 21 pesos level over the longer term, but we would need to see a huge run to the US dollar. We could have that happen, but that is probably more of a “risk-off” scenario than anything else that causes it to happen. The markets will continue to be paying close attention to a lot of moving pieces, and at this point you cannot count on too much more than volatility.

[ad_2]