[ad_1]

The factors of the euro’s weakness are still continuing, most notably the Russian war and its consequences. It has a chance of more bears taking over the EUR/USD track. The currency pair is closest to breaching the psychological support 1.0800. The discrepancy in economic performance and the future of monetary policy, as I mentioned before, is one of the most important factors for the weakness of the Euro-dollar as well. Recently, the exchange rates of the euro were shown at that time in the wake of the news that French President Emmanuel Macron had topped the first round of the presidential election, but this strengthening has already proven to be fleeting and one analyst says the euro should be sold on the list of reasons.

In this regard, Jordan Rochester, global forex strategist at Nomura, says he expects the collapse in confidence in the eurozone to affect euro portfolio flows further. In short, the macroeconomic bigger picture matters more than politics and as a result the bloc’s single currency is vulnerable to further declines. “For us, it is the macro, not Macron, that drives the vision,” the analyst stated in a note this week. “Political uncertainty in France provides another reason why the euro is not likely to trade well in the next two weeks, but it is not the only factor.”

The collapse of confidence in the eurozone is likely to affect euro portfolio flows, and “real rates are not rising as fast as the US, while ETF flows have slowed significantly.” He adds that the European Central Bank (ECB) is not likely to raise interest rates faster than the US Federal Reserve is doing, meaning that bond yields will still be skewed in favor of the dollar.

This acknowledges the view that the ECB will indeed raise rates, but there is a risk that “the ECB likely won’t validate July’s pricing of a potential rate hike yet.”

The forecast comes ahead of Thursday’s European Central Bank meeting where policy makers are likely to acknowledge rising inflation but sound caution about the damage to economic growth from Russia’s invasion of Ukraine. At the same time, Nomura points out that the investor’s position is not short on the euro, despite the fact that the euro-dollar exchange rate is trading near its lowest since May 2020. Often when the position on a currency is heavily biased in one direction or the other, it can be that the opposite trend occurs, as defining positions is inevitably required to restore balance.

More fundamental headwinds developed as the eurozone’s trade balance worsened significantly with the cost of imports and exports struggling in a difficult global economy. Accordingly, analysts say, this is likely to have a significant impact on flows. A new round of EU sanctions on Russia and moves to secure energy supplies from elsewhere suggest that it will take some time before returning to normal, energy prices are likely to remain elevated for some time, and that although China’s credit impulse may improve (the China market important for Eurozone exports), full feeding will take time and the conflict between Russia and Ukraine is a bigger factor for Eurozone growth at the moment.

Nomura has a strategy recommendation to “sell” the EUR/USD currency pair.

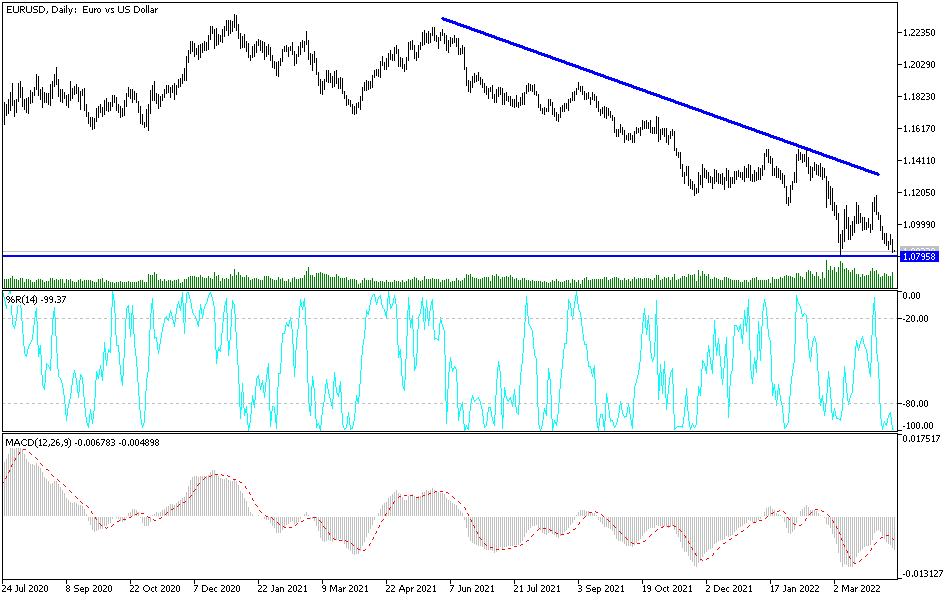

According to the technical analysis of the pair: There is no change in my technical view of the price performance of the EUR/USD currency pair. The general trend is still bearish, and the breach of the 1.0800 psychological support that is currently taking place reinforces the general trend and warns of a new sharp bearish move as long as the factors of the euro’s weakness persist. It is clear that investors do not care about technical indicators reaching oversold levels after the recent losses, and the currency pair continues to bleed its losses. The bears’ closest targets are currently 1.0765 and 1.0680, respectively.

According to the performance on the daily chart, the breach of the resistance 1.1200 is still important for a first shift in the trend. So far, I still prefer to sell EURUSD from every bullish level. Today’s economic calendar is devoid of important European data, and from the United States the PPI reading will be announced.

[ad_2]