[ad_1]

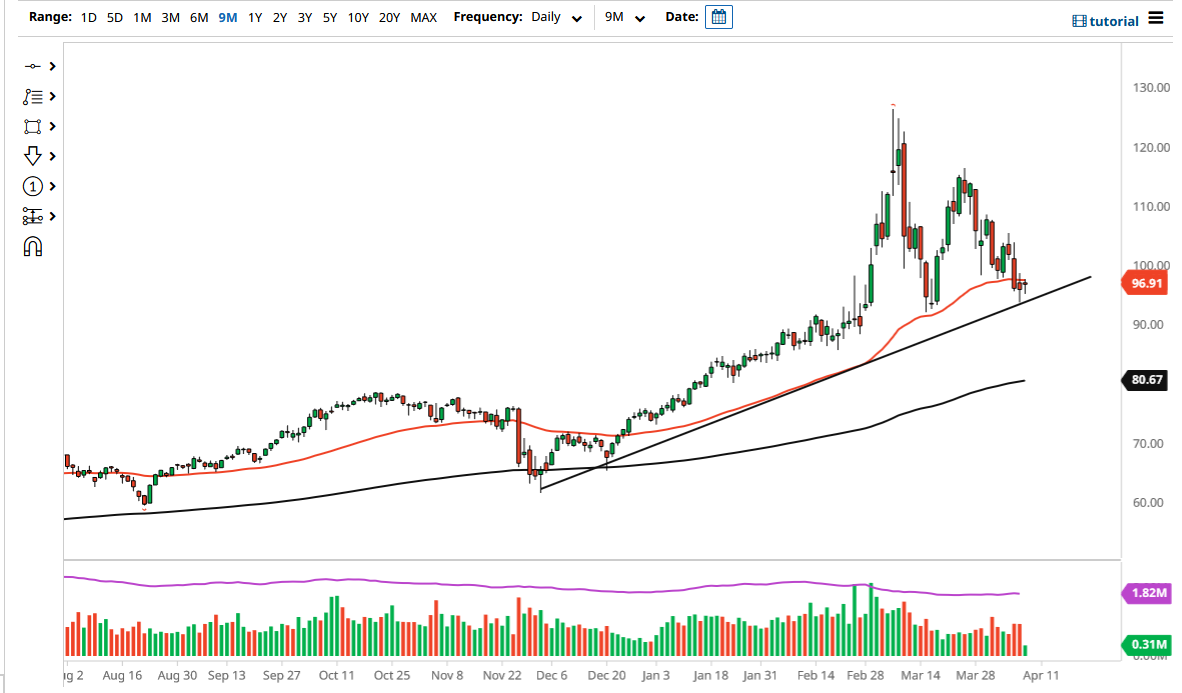

I am waiting to see what happens with this trend line before I start shorting, or the $100 level before I consider buying.

The West Texas Intermediate Crude Oil market went back and forth on Friday to form a bit of a hammer. We previously formed a hammer on Thursday, so that does suggest that we are at least putting up a fight. It is worth noting that we are just below the 50-day EMA, and just above a significant longer-term uptrend line. It will be interesting to see if the oil market can hang on here, because if it does not, we could see a massive selloff ahead.

The structure of the market certainly looks as if it is ready to fail, and the main reason why we might see that is that the gasoline demand has dropped drastically in the United States as higher prices have worked against the problem of, well… higher prices. That being the case, the market is likely to see a lot of volatility here, and we will have to wait and see whether or not we can get some type of impulsive candlestick in one direction or the other. I do believe that we should have an answer to this question over the next couple of sessions.

If we do break to the upside, we would need to close on a daily candlestick above the $100 level for me to even consider going long, because the selloff has been so drastic. Furthermore, there are now signs that the Iranians and the Venezuelans may be able to sell their oil in the open market, and if that is going to be the case, it could mitigate some of the losses of Russian supply.

Regardless, if we are getting ready to head into a global recession as many people believe, that is toxic for the crude oil markets, because you need a healthy economy to drive up demand for crude. At this point, it is worth noting that we had seen some hysterics just a few weeks ago about how oil was going to reach the $200 a barrel level, which is almost always a good sign that you are getting closer to the end than the beginning of the move. That being said, I am waiting to see what happens with this trend line before I start shorting, or the $100 level before I consider buying.

[ad_2]